Examples of divvy in a Sentence Recent Examples on the Web Netta Wang, a 23-year-old senior at Stanford University who has had symptoms for about six months, gets help from her roommates, who created a spreadsheet to divvy up her care—a sacrifice that is not lost on Wang.

- Divvy is the most versatile content planning and creation platform and a perfect complement to whatever other tools you use and love.

- A Divvy-Up is the correct and ideal tool to use for properly and cleanly fixing ball marks. Featured product FOUR-PACK DivvyUp Ball Mark Repair Tools.

- Divvy is bringing bikes and stations to the Far South Side, kicking off Lyft’s $50 million investment in the system’s expansion in partnership with the Chicago Department of Transit (CDOT).

Divvy Login

Google uses cookies and data to:- Deliver and maintain services, like tracking outages and protecting against spam, fraud, and abuse

- Measure audience engagement and site statistics to understand how our services are used

- Improve the quality of our services and develop new ones

- Deliver and measure the effectiveness of ads

- Show personalized content, depending on your settings

- Show personalized or generic ads, depending on your settings, on Google and across the web

Click “Customize” to review options, including controls to reject the use of cookies for personalization and information about browser-level controls to reject some or all cookies for other uses. You can also visit g.co/privacytools anytime.

The Divvy card is starting to make waves in the business world as a high-tech, free, business credit card. And, it’s more than that. This funding solution promises powerful budgeting software and more. But, can they deliver on these promises, and is a Divvy credit card right for you?

Here, you’ll find the answer. Let’s explore the following:

- What is a Divvy Card?

- This is What You Will Get as a Cardholder

Read to the end before you apply for a Divvy card.

What is a Divvy Card?

The Divvy Mastercard offers fast and flexible business credit for “all sized companies.” There are a handful of edges this card has over most of its competitors:

- A user-friendly platform for expense management, budgeting, and bill-pay

- The Divvy virtual card offers a modernized credit solution

- More frequent payments lead to higher bonus rewards

- Many services are free for the cardholder

Since they don’t charge the usual fees to cardholders, Divvy makes money by taking a portion of transaction fees charged to the merchant for each purchase.

While the talking points above are genuinely exciting, this card (like all financial services) has it’s pitfalls. For one, there is a lack of transparency about qualification requirements and fees. Next, Divvy imposes a minimum spending requirement — you have to spend a certain amount on the card each month to leverage the full benefits. Finally, Android users aren’t in love with Divvy’s mobile app.

When you hear the name, Divvy, you might think of a bike subscription service, stock purchase product, or homebuyer program. The Divvy business credit card is unrelated.

Now, let’s dive deeper.

What to Expect When You Apply for a Divvy Card

Divvy Homes

Your first step on the path to a Divvy account will be to check out the demo or to apply for business credit. The application process is pretty thorough yet easy.

You’ll be asked to provide banking information, income, and details about your business to determine the amount of credit you can qualify for. I love their application process because it leaves no stone unturned and gives you the option to include documentation upfront for a faster decision. But, I was so excited that I didn’t want to wait the three days it took to hear back from an account manager.

The system needs to analyze transactions from at least one business checking account to verify your income. You may use information from multiple bank accounts.

The platform will then average your monthly deposits and offer you a credit limit of roughly 30% of that amount. This is a charge card, which means you can’t carry a balance on a Divvy card — you’ll be required to pay the account in full each month.

So, Divvy doesn’t look at your credit score to qualify you. Instead, your spending limit is based on business bank deposits.

In some cases (maybe if you have overdrafted your business accounts in the past couple of years or show other high-risk spending behavior), you might be asked for a cash deposit to back your initial credit line, which is common practice for secured credit lines.

It might take a couple of weeks to get your card, but it’s worth the wait.

This is What You Will Get as a Cardholder

If you qualify for a Divvy account, you’ll get access to their exclusive expense management platform, virtual card(s), and rewards. Learn more about each.

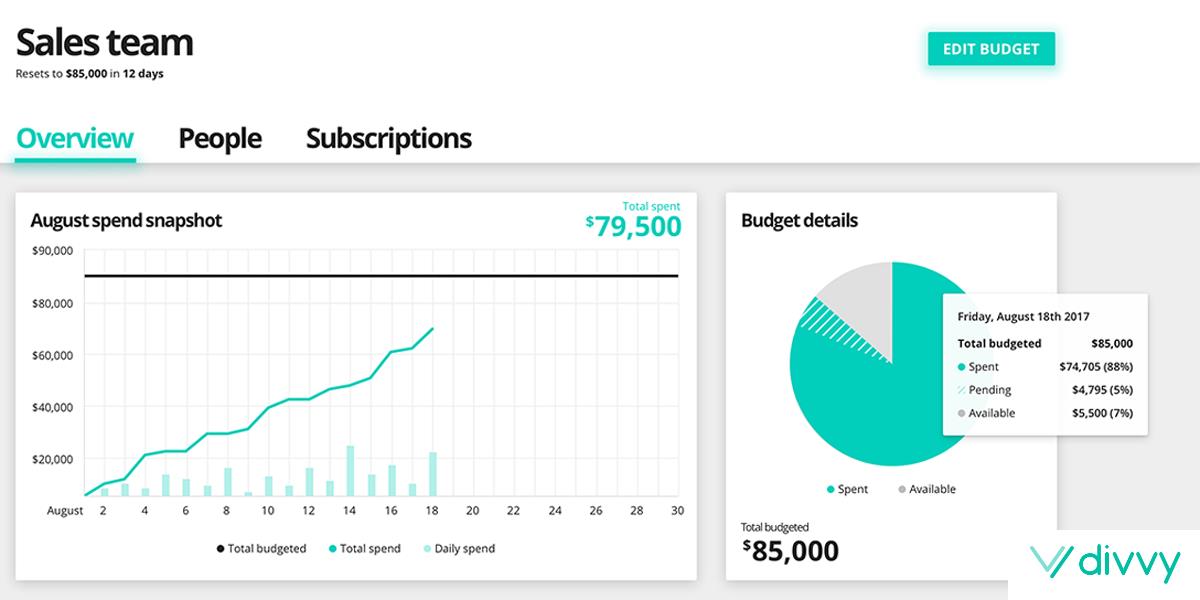

Divvy Expense Management

This expense management platform can help you manage expenses with your employees and within specific categories. Most users agree that this is a fantastic tool for corporate and small business budgets.

How does Divvy Expense work?

- Assign each employee a card with a budget

- Limit staff budgets on a case-by-case basis

- Enable budget increase requests for unexpected expenses

- Automatically categorize spending

- Enable spenders to upload receipts in the app

- Access spending reports in real-time

So, what’s the downside? To leverage these tools for free as the website assures, you need to spend at least $5K of your Divvy credit each month. So, lower budgets might not qualify.

I recommend you talk to an account manager to help you customize the platform for your needs. For example, you can allow or disallow features that you need and don’t need such as receipt photo uploads. Doing so, you can get a fully-personalized experience.

Divvy Homes

Another key detail about the system is that payments owed will be automatically withdrawn on your due date, the same day a statement is generated. Some users complain that they would like to see more flexibility including payment grace periods and more time for invoice review.

Divvy Virtual Card(s)

In addition to your physical card, each user can access virtuals card on their mobile device. Instead of a carbon copy of their original card, virtual cards act as a “burner credit card.” These can be particularly helpful for temporary subscription offers where a staff member could forget to cancel their account at the right time.

They’re also handy for situations when a card is compromised. Rather than wait a week or more for a new card or multiple cards to arrive in the mail, users can generate a new, 16-digit card number for use right away. Plus, this make the business spending experience super secure.

Divvy Card Reward Points

Reward points on Divvy card spending have three tiers. Each tier is based on how often the credit is paid off and earned points increase with frequent payments.

- Weekly

- 7X on restaurants

- 5X on hotels

- 2X on recurring software subscriptions

- 1.5X on everything else

- Semi-monthly

- 4X on restaurants

- 3X on hotels

- 1.75X on recurring software subscriptions

- 1X on everything else

- Monthly

- 2X on restaurants

- 2X on hotels

- 1.5X on recurring software subscriptions

- 1X on everything else

Rewards can then be spent on Divvy travel, gift cards, statement credit, or cash back.

$1,500 in restaurant spending for an account paid weekly can earn card users roughly $100 for travel, $51 for gift cards, $49 statement credit, or $52 cash back. And, that’s not all.

Card users can leverage partner discounts. While these are likely to change, right now the card holder sign-on bonus is a 2-year, $25,000 credit for AWS Activate. Users can also get $150 off Google Ads, $15 off any print order with FedEx Office, $50 off a phone at Verizon, and many other discounts when they pay with their card.

Divvy Card Customer Service

The customer service at Divvy gets mixed reviews. I know that front-end communication is automated through Intercom.™ One of the impressive features of this platform is that customers get access to their entire conversation, without logging in, from the company’s main website.

So, you know that the customer service team has access to these conversations as well, which is nice. Plus, Divvy’s help center is a pretty extensive knowledgebase designed to help users with everything from managing cards to reimbursements and more. You can also email help@getdivvy.com or call 385-352-0374 to leave a message with a representative.

Divvy Credit Card

Does Divvy Report to Credit Bureaus?

Another awesome feature of Divvy is that they do report on-time payments to the Small Business Financial Exchange (SBFE). The SBFE then reports your payment behavior to the following bureaus:

- Equifax

- Experian

- Lexis Nexis Risk Solutions

So, cardholders get a charge card, often with net 30 payment terms, cards for their staff, burner cards for subscriptions and other temporary costs, and a full-suite expense tracking platform. Plus, they build business credit. It’s a pretty incredible offer.

Divvy vs Brex vs Stripe Capital

Now, let’s just take a quick look how Divvy stacks up next to Brex and Stripe (all of which are free). Find out if this offer holds it’s ground.

While Divvy claims to have no fees, users report foreign transaction fees, which Brex and Stripe don’t have. The lack of transparency might indicate more surprises down the road.

And, while Stripe and Brex don’t have the same built-in advanced expense tracking as Divvy, they provide other special features. For example, Brex can be used like a bank account with no ACH transfer fees and Stripe lets you see income and expenses in one dashboard.

Conclusion: Should You Get a Divvy Card?

Ask yourself the following:

- Does your monthly business spending exceed $5K?

- Do multiple staff members have business spending privileges?

- Are you able to pay your expenses in full each month?

If you answered, ‘yes, yes, yes,’ the Divvy credit card might be right for you. I love this card and do recommend you check it out. Sign up now to see the credit line you might qualify for. And, if you’re interested in learning how you can obtain up to $100K in business credit in as little as 30 days, become a Business Credit Workshop member today.

Related posts: